|

Following is part 2 of 2, focusing on commerce, consumer & market dynamics, and the implications on go to market strategies.

In part 1 of 2, we assessed the pandemic’s implications on capital accessibility & financial management for CPG, especially for emerging brands. Read Part 1 here. For context, part 2 begins with the same opening paragraph as part 1. As I write, events continue to unfold before our eyes, the flow of information is constant, and the entirety of what’s happening is fluid. We know the COVID-19 pandemic has created an unprecedented time of uncertainty, a range of emotions, and behavioral changes. Take a moment to breathe (like right now). The disruption we’re experiencing is extraordinary, but it is temporary, and we will return to normal even if a new normal is yet to be defined. What’s happening with commerce/sales dynamics:

What it means:

As I write, events continue to unfold before our eyes, the flow of information is constant, and the entirety of what’s happening is fluid. We know the COVID-19 pandemic has created an unprecedented time of uncertainty, a range of emotions, and behavioral changes. Take a moment to breathe (like right now). The disruption we’re experiencing is extraordinary, but it is temporary, and we will return to normal even if a new normal is yet to be defined.

This is part 1 of 2, where we’ll assess the pandemic’s implications on capital accessibility & financial management for CPG, especially for emerging brands. Part 2, here, focuses on commerce, consumer & market dynamics, and their implications on go to market strategies. What’s happening with capital:

Note that the above applies to “many”, not all. Several investors assured me they are still actively seeking deals and to deploy capital as close to the pace as they have been, and are maintaining the same criteria as before. What it means:

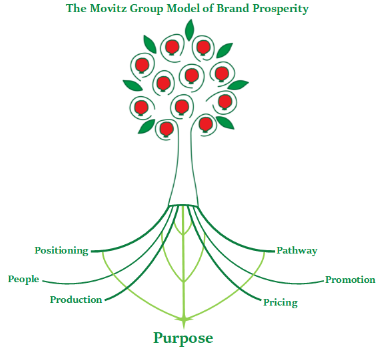

Brand prosperity is a lot like the root system of a tree. Although hidden beneath the soil, the root system of a tree is the origin of its strength, stability and capacity to flourish. A nourished root system grows a tree that produces a bountiful yield. Conversely, a deprived root system can compromise the tree’s ability to produce at all. In similar fashion, the root system for a brand must be strong and healthy for the brand to prosper. Each root is an integral part of a brand’s path to not just bear fruit, but flourish. A strong root system for a brand is rooted in a disciplined and methodical Go to Market strategy. This is the sixth in an 8-week series outlining the framework of a successful Go to Market strategy. The previous articles can be found here: First: Purpose Second: Product Strategy Third: Production Strategy Fourth: People (Consumer) Strategy Fifth: Pathway (Commerce) Strategy The sixth root in a successful Go to Market strategy is the focus of this article: Pricing Strategy. Thank you for your interest in this topic. We welcome your feedback and comments, and the opportunity to help you on your journey. *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** Despite the best efforts of even the most brilliant business people, if you’re losing money on your product, you can not make it up in volume, try as you might…

Kidding aside, pricing is rightly perceived as one of the more complex elements of a go to market strategy because there are so many two-way factors interacting, each influencing and being influenced – including, unfortunately, emotions and rationalization tendencies of a founder. Optimal pricing will depend on costs, how competitors are priced, and what potential customers will pay. Finding this optimal number takes time, research and data. Pricing is also strongly correlated to, and, simultaneously influencing and being influenced by:

Pricing is also a strong influencer defining a brand’s addressable market/consumer accessibility, as well as defining trade promotional campaigns, but at the end of the day, building a sustainable pricing model that drives profitability matters most, because without profits, there isn’t an ongoing concern. Strategy Taking a step back, let’s think strategically about pricing over time and by channel (exclusive of cost input drivers). In your early days, your initial pricing is targeted to the highest value consumers - innovator and early adopter consumers who care the most about the brand and who have a willingness to pay more. Long term, consider how your price will evolve over time as consumer adoption matures. Below is a recommendation target we made to a client for pricing evolution over time, overlaid on the consumer adoption curve (for a more detailed treatment of this consumer adoption curve, check out the fourth installment in this series: People (Consumer) Strategy): Brand prosperity is a lot like the root system of a tree. Although hidden beneath the soil, the root system of a tree is the origin of its strength, stability and capacity to flourish. A nourished root system grows a tree that produces a bountiful yield. Conversely, a deprived root system can compromise the tree’s ability to produce at all.

In similar fashion, the root system for a brand must be strong and healthy for the brand to prosper. Each root is an integral part of a brand’s path to not just bear fruit, but flourish. A strong root system for a brand is rooted in a disciplined and methodical Go to Market strategy. This is the fifth in an 8-week series outlining the framework of a successful Go to Market strategy. The previous articles can be found here: First: Purpose Second: Product Strategy Third: Production Strategy Fourth: People (Consumer) Strategy The fifth root in a successful Go to Market strategy is the focus of this article: Pathway (Commerce) Strategy. Thank you for your interest in this topic. We welcome your feedback and comments, and the opportunity to help you on your journey. *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** Imagine you’re selling your newly launched brand in a few dozen locations, and the Kroger or Target buyer expresses interest in placing your product in 250 locations. Should you do it? What if the Walmart buyer agrees to place your specialty product in line with the traditional CPG competitive set “to maximize shopper exposure”? Should you do it? If you’ve been selling your new brand on your own web site for the last 3 months, are you ready to start selling in brick & mortar retail? Most of the time the answer to these questions is “probably not”, but of course, the answer depends on many factors. Having a compass and benchmarks to help arrive at these decisions methodically, with focus and with discipline is vital. Hopefully I’ll shed some light on the many considerations when developing or refining your commerce strategy. Brand prosperity is a lot like the root system of a tree. Although hidden beneath the soil, the root system of a tree is the origin of its strength, stability and capacity to flourish. A nourished root system grows a tree that produces a bountiful yield. Conversely, a deprived root system can compromise the tree’s ability to produce at all. In similar fashion, the root system for a brand must be strong and healthy for the brand to prosper. Each root is an integral part of a brand’s path to not just bear fruit, but flourish. A strong root system for a brand is rooted in a disciplined and methodical Go to Market strategy. This is the fourth in an 8-week series outlining the framework of a successful Go to Market strategy. The previous articles can be found here: First: Purpose Second: Product Strategy Third: Production Strategy The fourth root in a successful Go to Market strategy is the focus of this article: People (Consumer) Strategy Thank you for your interest in this topic. We welcome your feedback and comments, and the opportunity to help you on your journey. *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** If we work “backward” to create a successful product, we start with identifying the market gap or need for a solution. Subsequently, we identify when or how this solution would be used (use occasions), and third, we define the consumer or user who benefits from this solution. Let’s stop there for a moment - we have yet to consider it’s selling price, what content should be on its Amazon.com page, from where ingredients are sourced, or even naming our founding values. Implicit in the very notion of this process as the “backward” version is that it’s either wrong or it’s not common practice. Unfortunately, it’s the latter, and the result is short lived or underperforming products because the go to market structure focused on the logistics, operations, and B2B partnerships to get a product on shelf, and/or grossly over simplified the consumer as a ‘millennial’ or ‘millennial mom’, which is too broad to effectively, efficiently, and financially target.

Whether we work “forward” or “backward” to dive into our consumer strategy, there are three key questions to ask at this critical stage to define the consumer who benefits from our solution:

Brand prosperity is a lot like the root system of a tree. Although hidden beneath the soil, the root system of a tree is the origin of its strength, stability and capacity to flourish. A nourished root system grows a tree that produces a bountiful yield. Conversely, a deprived root system can compromise the tree’s ability to produce at all. In similar fashion, the root system for a brand must be strong and healthy for the brand to prosper. Each root is an integral part of a brand’s path to not just bear fruit, but flourish. A strong root system for a brand is rooted in a disciplined and methodical Go to Market strategy. This is the third in an 8-week series outlining the framework of a successful Go to Market strategy. The previous articles can be found here: First: Purpose Second: Product Strategy The third root in a successful Go to Market strategy is the focus of this article: Production Strategy. Thank you for your interest in this topic. We welcome your feedback and comments, and the opportunity to help you on your journey. *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** Many service providers focus on sourcing suppliers for ingredients, packaging, and manufacturing/production, as well as oversight and advisory on the operational logistics associated with the aforementioned elements. It is highly likely an early stage brand will work with one or more of these fine partners and companies, and likely stay with them as they grow. While navigating each process there are dozens of questions to help providers define the product “spec” – specifications that guide them to conduct searches and manage processes to the founder’s expectations and arrive at the desired outcome.

Defining your values and Purpose before entering these processes is critical to ensuring the end result is consistent with your original vision, or in the very least, provides a compass to guide you in the many decisions and changes you may need to adapt to along the way. For background on defining Purpose, see this article, the first in this series. This article focuses on the decisions made surrounding a product’s Production that create or impact its positioning. Ingredients Ingredients are a focal point for consumers when considering a product. In broad terms, consumers consider the following characteristics about ingredients:

You could conduct or buy consumer research to identify the importance of these in your category, but let’s save the research time and money – choose to take a leadership position on ingredient quality and standards. Don’t accept the structure and inertia of the food processing system to dictate your options – set your standards and go after it. Not all ingredients are created equal and one of the most consequential decisions for ingredient supply is quality/integrity vs price. Often these are directly correlated (as price increases, quality increases). Different tests evaluate different factors to help determine the “quality” of an ingredient, and it’s important to conduct them or obtain certified results to verify. It’s also an implicit part of transparency. Core to a brand’s revenue growth is a disciplined and methodical Go to Market strategy. This is the second in an 8-week series outlining the framework elements of a successful Go to Market strategy. The first focused on Purpose and can be found here. The second core element to a successful Go to market strategy is the focus of this article: Product.

When selling a product, the bottom line goal is to sell (1) The right product, in (2) The right place, at (3) The right price, at (4) The right time, to (5) The right consumer target. This article will focus on product, with a reference to place as merchandising. Place is typically considered the selling outlet or vehicle. This and the other components of this equation will be addressed in subsequent articles. Thank you for your interest in this topic. We welcome your feedback and comments, and the opportunity to help you on your journey. *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** Although its authenticity is impossible to confirm, one of my favorite quotes of all time is attributed to Charles H. Duell, Commissioner of the US patent office in 1899. According to legend, Mr. Duell claimed that, "Everything that can be invented, has been invented" If this were in fact the case, everything that was created in the last 119 years – and I mean everything – would not exist. Nor would our own dreams of what could be possible, or those of every generation to come, would ever be manifest into reality. Man, that’s a real bummer. Thankfully this isn’t the case, and in fact, it’s just the opposite. Our world is alive with new ideas, new breakthroughs, and new products every single day. If you’re a fan of food, beverage, personal care and wellness product discovery, there is no shortage of new products to delight, entice, intrigue, and engage with on a daily basis. Therein lies the conundrum – it’s never been easier to start a new brand, whether as a personal mission, opportunistic entrepreneur, or defensive strategy, yet the chances of success are small (it depends how one defines “success”, but let’s use a general notion of a sustainable business model with a meaningful level of target consumer awareness, category market share, household penetration, and profitability). I won’t cite statistics because that’s not the point to center on. This is: product strategy requires thoroughly defining multiple positioning points, but success is dependent on differentiating through the right ones. Consider this: do we really need another salsa? BBQ sauce? Peanut butter? Coffee? The answer is, actually, maybe. Thinking there’s nothing else that could be invented could easily lead to product commoditization. At best this thinking suggests the only opportunity for new product introductions are iterations of existing items (lower sodium or sugar, new size or flavor, etc.), and at worst, complacency with what exists and how things are. Thankfully there are acutely curious & observant people among us who see beyond the here and now to what “could be” with the passion to drive their ideas forward. And that is the first tenet of a successful product: Core to a brand’s revenue growth is a disciplined and methodical Go to Market strategy. This is the first post in an 8-week series outlining the framework elements of a successful Go to Market strategy. We begin with an introduction to a strong foundation, the evolution of the classic marketing mix (“The 4 P’s”), and the first principle all founders need to internalize.

Thank you for your interest in this topic. We welcome your feedback and comments, and the opportunity to help you on your journey. *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** *** Hidden beneath the soil, the root system of a tree is the origin of its strength, stability, and capacity to flourish. A nourished root system raises a tree that produces a bountiful yield. Conversely, a deprived root system can compromise the tree’s ability to produce at all. Above the soil, the sun provides light and energy to complete nature’s process for its beauty and personality to be expressed in all its glory. What does this have to do with how a consumer packaged goods brand brings its products to market? In similar fashion, the root system for a brand must be strong and healthy for the brand to prosper. Each root is an integral part of a brand’s path to not just bear fruit, but to flourish. Consider the classic marketing matrix of the 4 Ps: Product, Place, Price & Promotion. The fundamentals of the Four Ps are still relevant, but the dynamics surrounding them have evolved – Following is a transcript of the interview by Matt Levine of Cornucopia Show podcast in mid-September, released on November 3, 2017 MATT LEVINE:

We're here with Mike Movitz. Mike, good to have you back on Cornucopia. MICHAEL MOVITZ: Thank you, Matt. Good to be back. MATT LEVINE: Let's talk about Campbell's, a company that made canned foods a staple in every American kitchen and currently a company that's undergoing a lot of transformation. Before we begin I'll just read a list of a few of the brands they own: Prego, Spaghetti O's, Pepperidge Farm, Bolthouse Farms, V8, Pace Salsa, Plum Organics baby food, and most recently the purchase of Pacific Foods, natural and organic soup maker. Mike, give us a little update on what Campbell's has been doing and why it's important in terms of this current shift in consumer focus away from more processed to less processed foods. MICHAEL MOVITZ: I think to understand where Campbell's is headed, we need to understand the context of what's happening in general in the traditional food world. There is a seismic shift taking place on many fronts. For one, consumer eating habits have changed dramatically. When we think about the idea of three square meals a day, only five percent of consumers are actually eating three square meals a day. That is a thing of the past. Ninety percent of consumers today snack multiple times a day, and the lines between snacking and a meal is blurring. There's changes in demographics; changes in how people are interacting with and thinking about the importance of good food in their life; a consumer’s ideas about a company’s transparency, how they relate to that company, how authentic a company is, the values that company has and do they relate to the consumer’s values; Of course, there is e-commerce, digital and mobile technology disrupting retail and our shopping and buying habits; home delivered meals, meal kits, and prepared foods; and the shift from what we call center store of non-perishable products to the perimeter departments where the refrigerated and fresher food departments are. Whether that's dairy, produce, deli, meat, seafood, prepared foods, et cetera. All of these changes have been occurring at a at breakneck speed, much faster than companies were prepared for, nor was it really foreseen coming. In Mid-September 2017 Michael Movitz was interviewed on the Cornucopia podcast about how CPG companies are responding to the current consumer demand for better for you products, and why it matters. The podcast will be released soon, and in the meantime, below is an excerpt from the interview.... The speed of change as well as the number of changes that are happening creates a very fluid and new dynamic that literally is rewriting the playbook for the path to consumer as we speak. Traditional CPG companies were built on a business model of scale for efficiency, and that really hindered their ability to adapt, respond, react and move with speed. We started to see a number of years ago the natural, organic and specialty products industry had been growing very well for a long time but suddenly it was becoming much more front and center, and it was where all the growth was. More than $20 billion dollars in market share has been lost by traditional CPG over the last five or so years and it's all moved to these smaller start up and natural organic specialty premium product companies.

As traditional CPG has started to get a grasp on what has been changing, they've |

About The Author...Michael Movitz has more than 25 years natural/organic products industry experience across retail, manufacturer, broker and market research organizations... Archives

March 2020

Categories

All

|

ServicesSpeed of NatureFollow Us! |

Company |

|

© COPYRIGHT 2017. ALL RIGHTS RESERVED.

RSS Feed

RSS Feed